We are pleased to invite finance researchers, academics, and practitioners to the 1st Modern Finance Conference (MFC), to be held at Kozminski University in Warsaw, Poland, on 15-17 September 2024. The event aims to provide a platform for the dissemination of cutting-edge research, innovative ideas, and novel approaches across all areas of finance. The conference will be held in a hybrid format, combining in-person and online sessions.

Conference program

Warsaw Tour and Sightseeing, Meeting Point: Sigismund's Column, Castle Square (pre-registration required) learn more

Early Registration and Welcome Drink, Ibis Kitchen at Ibis Warszawa Stare Miasto hotel, ul. Muranowska 2, Warsaw (pre-registration required) learn more

Opening remarks learn more

Jacek Tomkiewicz, Kozminski University, Dean of the College of Finance and Economics

Adam Zaremba, Modern Finance Institute

Keynote address learn more

|

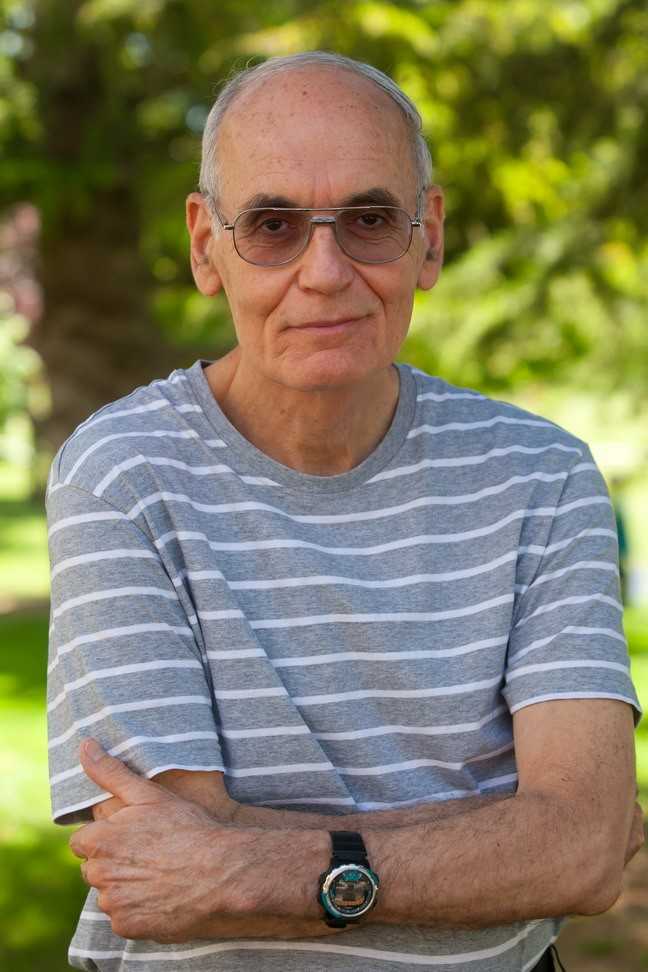

Prof. Ilan Alon is Dean and Full Professor of the School of Economics at the College of Management Academic Studies (Israel) and Professor II at the University of Agder (Norway). He holds a Ph.D. from Kent State University (USA) and his previous academic experience includes top universities worldwide such as Harvard University, Georgetown University, Copenhagen Business School, and Jiaotong University. His research revolves around crypto economics (digital currencies) and international business. His works have been published in top-tier journals and resonate within and outside of the academic world. He also serves as the Editor-in-Chief of the International Journal of Emerging Markets. Prof. Alon also has served as a consultant to various government agencies, such as the United Nations and USAID, and multinational companies, such as Disney and illy. Finally, he is a frequent speaker or writer on various international networks including National Public Radio (USA), Voice of America (USA), and the Financial Times (UK). |

Parallel sessions learn more

|

In-person presentation

Presenters:

Lukas Petrasek (Institute of Economic Studies, Faculty of Social Sciences, Charles University)

Authors:

Lukas Petrasek (Institute of Economic Studies, Faculty of Social Sciences, Charles University)

|

|

Online presentation

Presenters:

Safae Benfeddoul (The National School of Business and Management, Sidi Mohamed Ben Abdallah University, Fez, Morocco.)

Authors:

Safae Benfeddoul (The National School of Business and Management, Sidi Mohamed Ben Abdallah University, Fez, Morocco.), Asmaa Alaoui Taib (The National School of Business and Management, Sidi Mohamed Ben Abdallah University, Fez, Morocco.)

|

|

Online presentation

Presenters:

Carlos Pinheiro (Universidade Europeia)

Authors:

Maria Carlos Annes (Lisbon Accounting and Business School), Domingos Cristóvão (Lisbon Accounting and Business School), João Sobral Rosário (Lisbon Accounting and Business School), Carlos Pinheiro (Universidade Europeia)

|

|

In-person presentation

Presenters:

Xiaoquan Jiang (Florida International University)

Authors:

Xiaoquan Jiang (Florida International University)

|

Parallel sessions learn more

|

In-person presentation

Presenters:

Kuan-Cheng Ko (National Chi Nan University)

Authors:

Kuan-Cheng Ko (National Chi Nan University), Nien-Tzu Yang (National United University)

|

|

In-person presentation

Presenters:

Zihan Gong (technical university of munich)

Authors:

Zihan Gong (technical university of munich), Sebastian Müller (technical university of munich)

|

|

In-person presentation

Presenters:

Gerrit Liedtke (University of Bremen)

Authors:

Gerrit Liedtke (University of Bremen), Christian Fieberg (Hochschule Bremen - City University of Applied Sciences), Thorsten Poddig (University of Bremen), Paige Michael-Shetley (University of Bremen), Thomas Walker (Concordia University)

|

|

In-person presentation

Presenters:

Gabor Neszveda (Central Bank of Hungary)

Authors:

Gabor Neszveda (Central Bank of Hungary)

|

|

In-person presentation

Presenters:

Jairaj Gupta (University of York, United Kingdom)

Authors:

Jairaj Gupta (University of York, United Kingdom), R. Shruti (Indian Institute of Technology, Madras, India), Xia Li (Birmingham City University, United Kingdom)

|

|

Online presentation

Presenters:

Bing Xu (University of Oklahoma)

Authors:

Bing Xu (University of Oklahoma)

|

|

In-person presentation

Presenters:

Małgorzata Iwanicz-Drozdowska (Warsaw School of Economics )

Authors:

Małgorzata Iwanicz-Drozdowska (Warsaw School of Economics ), Marzanna Lament (Casimir Pulaski Radom University ), Bartosz Witkowski (Warsaw School of Economics )

|

|

In-person presentation

Presenters:

Katarzyna Kwiatkowska (University of Szczecin)

Authors:

Katarzyna Kwiatkowska (University of Szczecin)

|

|

In-person presentation

Presenters:

Bita Mashayekhi (University of Tehran), Zabihollah Rezaee (University of Memphis)

Authors:

Bita Mashayekhi (University of Tehran), Samira Ghasemi Dashtaki (University of Tehran), Hosseyn Ahmadi (Arak University), Zabihollah Rezaee (University of Memphis)

|

|

In-person presentation

Presenters:

Joanna Rachuba (University of Szczecin)

Authors:

Joanna Rachuba (University of Szczecin), Urszula Mrzyglod (University of Gdańsk), Dorota Skała (University of Szczecin)

|

|

In-person presentation

Presenters:

Joshua Yindenaba Abor (University of Ghana Business School & ECOWAS Bank for Investment and Development)

Authors:

George Nana Agyekum Donkor (ECOWAS Bank for Investment and Development), Joshua Yindenaba Abor (University of Ghana Business School & ECOWAS Bank for Investment and Development)

|

|

In-person presentation

Presenters:

Sabat Kumar Digal (Rama Devi Women's University)

Authors:

Sabat Kumar Digal (Rama Devi Women's University)

|

|

In-person presentation

Presenters:

Paweł Lont (University of Łódź), Klaudia Zielińska-Lont (University of Lodz)

Authors:

Paweł Lont (University of Łódź), Klaudia Zielińska-Lont (University of Lodz)

|

Parallel sessions learn more

|

In-person presentation

Presenters:

Eduard Toerien (University of Pretoria)

Authors:

Eduard Toerien (University of Pretoria)

|

|

In-person presentation

Presenters:

Mariusz Karwowski (Warsaw School of Economics), Katarzyna Kobiela-Pionnier (Warsaw School of Economics)

Authors:

Mariusz Karwowski (Warsaw School of Economics), Katarzyna Kobiela-Pionnier (Warsaw School of Economics), Paweł Czyżewski (Warsaw School of Economics)

|

|

In-person presentation

Presenters:

Viara Bojkova (Global Policy Institute (London))

Authors:

Michael Lloyd (Global Policy Institute), Viara Bojkova (Global Policy Institute (London))

|

|

In-person presentation

Presenters:

Hiroshi Gunji (Daito Bunka University)

Authors:

Hiroshi Gunji (Daito Bunka University), Kazuki Miura (Aichi Gakuin University)

|

|

In-person presentation

Presenters:

Michael Asiamah (University of Szeged, Hungary)

Authors:

Michael Asiamah (University of Szeged, Hungary)

|

|

In-person presentation

Authors:

Konrad Borowicz (Tilburg University )

|

Conference Dinner, "Podwale" Restaurant, 25 Podwale Street, Warsaw (pre-registration required) learn more

Parallel sessions learn more

Parallel sessions learn more

|

In-person presentation

Presenters:

Vaibhav Lalwani (XLRI Xavier School of Management Delhi-NCR, India)

Authors:

Vaibhav Lalwani (XLRI Xavier School of Management Delhi-NCR, India), Vedprakash Meshram (Goa Institute of Management, Goa, India), Varun Jindal (Indian Institute of Management Bangalore)

|

|

Online presentation

Presenters:

Raffaella Barone (University of Salento)

Authors:

Raffaella Barone (University of Salento)

|

|

Online presentation

Presenters:

Yi Zhou (San Francisco State University)

Authors:

Yi Zhou (San Francisco State University)

|

|

In-person presentation

Presenters:

Christian Fieberg (Hochschule Bremen)

Authors:

Christian Fieberg (Hochschule Bremen)

|

|

In-person presentation

Presenters:

Juan Imbet (Paris Dauphine PSL)

Authors:

Juan Imbet (Paris Dauphine PSL), Marcelo Ortiz (Pompeu Fabra University), Vincent Tena (Paris Dauphine PSL)

|

|

In-person presentation

Presenters:

Daniel Kim (Chung-Ang University)

Authors:

Daniel Kim (Chung-Ang University), Domenico Tarzia (Peking University), Srinivasan Selvam (EDHEC Business School), Marco Giarratana (IE Business School)

|

|

In-person presentation

Presenters:

Clinton Watkins (Akita International University)

Authors:

Clinton Watkins (Akita International University)

|

|

In-person presentation

Authors:

Katarzyna Byrka-Kita (University of Szczecin), Paweł Witkowski (University of Szczecin), Jakub Lasota (QVISTORP S.A.)

|

Editors' roundtable learn more

|

|

|

|

|

Marco Vivarelli

Editor-in-Chief

Eurasian Business Review

|

Chun-Ping Chang

Editor-in-Chief

Innovation and Green Development

|

Sabri Boubaker

Editor-in-Chief

Journal of International Financial Management & Accounting

|

Ilan Alon

Editor-in-Chief

International Journal of Emerging Markets

|

Parallel sessions learn more

|

In-person presentation

Presenters:

Xin Long (ESSEC Business School)

Authors:

Xin Long (ESSEC Business School)

|

|

Online presentation

Presenters:

Vera Pankova (Center for Macroeconomic Analysis and Short-Term Forecasting )

Authors:

Vera Pankova (Center for Macroeconomic Analysis and Short-Term Forecasting )

|

|

Online presentation

Presenters:

Anselm Komla Abotsi (University of Education, Winneba)

Authors:

Anselm Komla Abotsi (University of Education, Winneba)

|

|

In-person presentation

Presenters:

Azhan Rashid Senawi (Universiti Teknologi MARA)

Authors:

Azhan Rashid Senawi (Universiti Teknologi MARA)

|

|

In-person presentation

Presenters:

João Reis (Universidade Europeia)

Authors:

João Reis (Universidade Europeia), Carlos Pinheiro (Universidade Europeia), Alberto Pozzolo (Roma Tre Univerity), Andrew Clare (Bayes Business School)

|

|

In-person presentation

Presenters:

Paweł Stępniak (Politechnika Wrocławska)

Authors:

Paweł Stępniak (Politechnika Wrocławska), Zbigniew Palmowski (Politechnika Wrocławska)

|

|

In-person presentation

Presenters:

Marcel Freyschmidt (University of St. Gallen)

Authors:

Marcel Freyschmidt (University of St. Gallen)

|

|

In-person presentation

Presenters:

Piotr Mielus (Szkoła Główna Handlowa w Warszawie)

Authors:

Piotr Mielus (Szkoła Główna Handlowa w Warszawie)

|

Closing address learn more

|

Oded Stark is Distinguished Fellow at the Center for Development Research, University of Bonn, and Distinguished Professor at the University of Warsaw. He served as Adjunct Professor at the University of Tuebingen, Distinguished Research Scholar at Georgetown University, University Professor (Chair in Economic and Regional Policy) at the University of Klagenfurt, Honorary University Professor of Economics at the University of Vienna, Professor of Economics (Chair in Development Economics) at the University of Oslo, and as Professor of Population and Economics and as the Director of the Migration and Development Program at Harvard University. Oded Stark is Doctor honoris causa (University of Warsaw), a Humboldt Awardee, a Ministry of Science and Higher Education (Poland) Lifetime Achievement Awardee, and a Presidential Professor of Economics (Poland). Prof. Oded Stark is a prolific researcher whose outstanding work has been published and cited in top economics journals. In the RePEc / IDEAS ranking of economics professors, he is listed three times: top 1% in the European Union, top 1% in Europe, and top 1% in the world. |

.jpg)